Structured Settlements

Five Questions to Ask About an Insurance Company

About to structure your settlement? Here are five questions to ask about the insurance company that will guarantee your settlement.

A structured settlement annuity provides you with guaranteed payments over a designated period—for several years and even through your lifetime.1

That’s why it’s important to carefully evaluate the insurance company guaranteeing your structured settlement and find the best option for you.1 Use the questions below to help guide you during the decision-making process.

1. How long has the insurance company been active in the structured

settlement market?

Long-term financial products like a structured settlement annuity should come from long-term providers that have a diverse mix of business. Look for insurance companies who have been consistently offering structured settlements for many years and have industry expertise.

2. What are the insurance company’s credit ratings?

Ask for the insurance company’s credit ratings or look for them on the company website. Credit ratings are strong indicators of an insurance company’s financial stability and their ability to provide you with guaranteed future payments.1

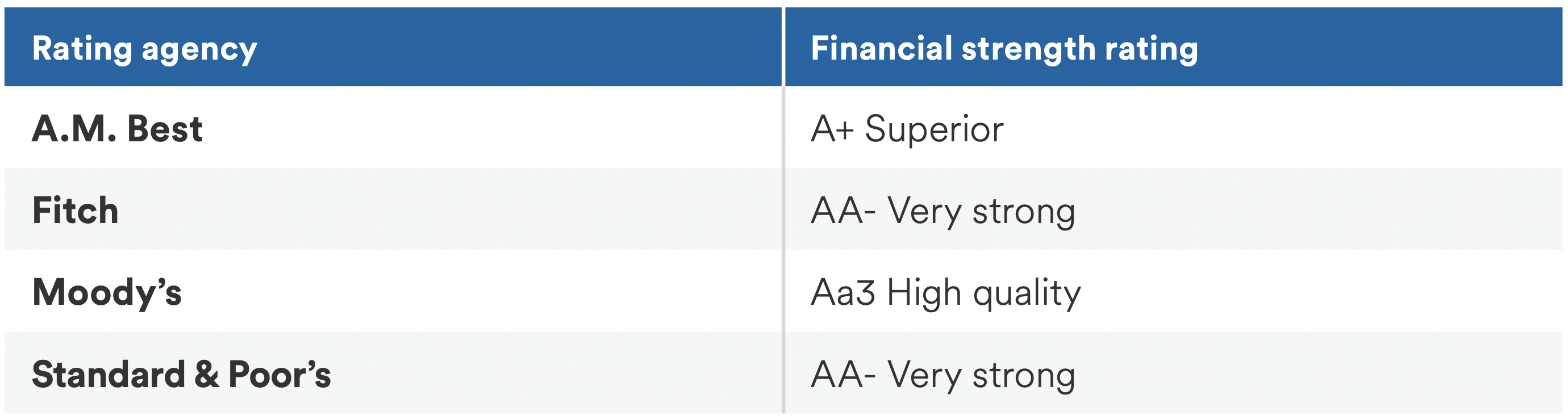

Credit ratings are shown as a letter or series of letters, such as Aa3 or B. There are four major insurance company rating agencies: A.M. Best, Moody’s, Standard & Poor’s, and Fitch. Because each agency has its own rating scale, the same insurance company could receive different ratings from the various agencies. Please visit the rating companies’ websites for definitions of their rating scales.

3. What is the size and strength of the insurance company?

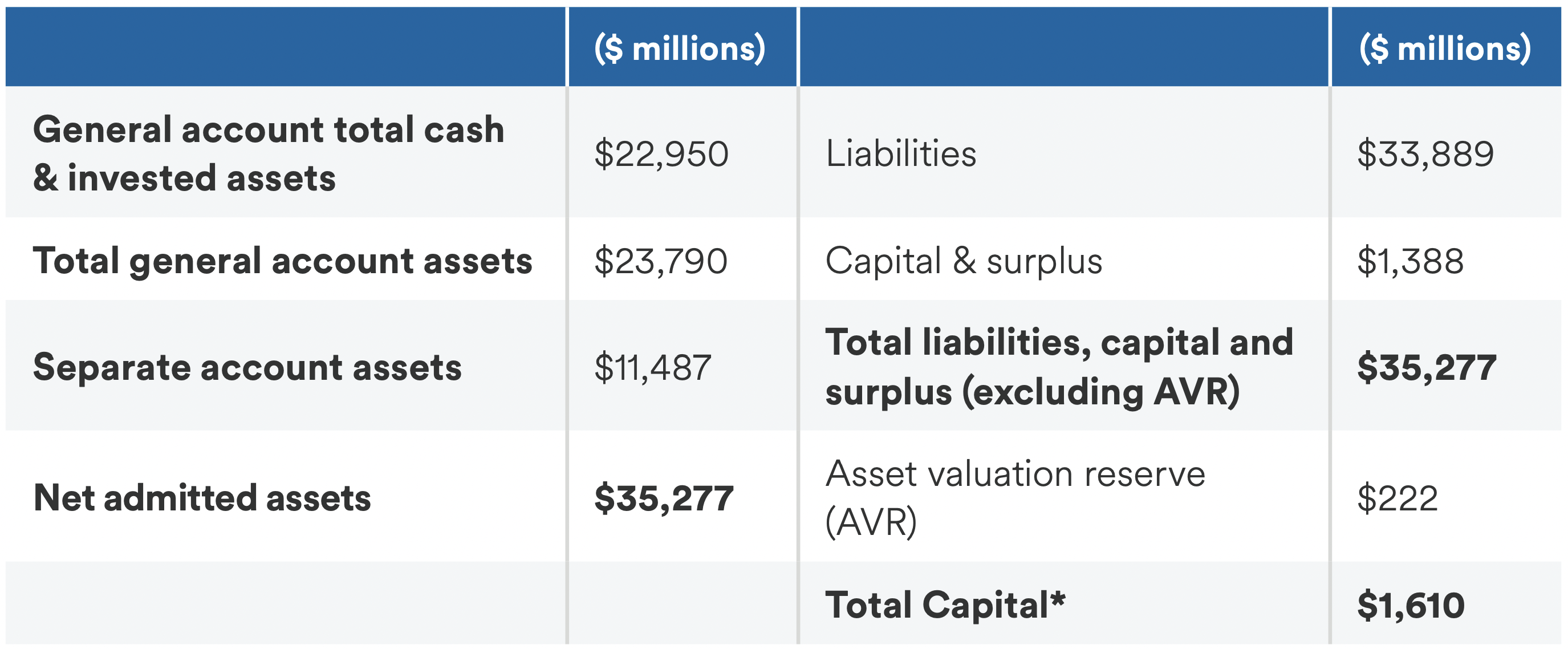

Ask for the insurance company’s Financial Quality statement or look it up on their website. You can assess the insurance company’s total assets versus their total liabilities. Total capital, often defined as capital plus surplus, is another key metric. Both assets vs. liabilities and total capital are important indicators of an insurance company’s financial strength.

4. What is the insurance company’s general account investment portfolio composed of?

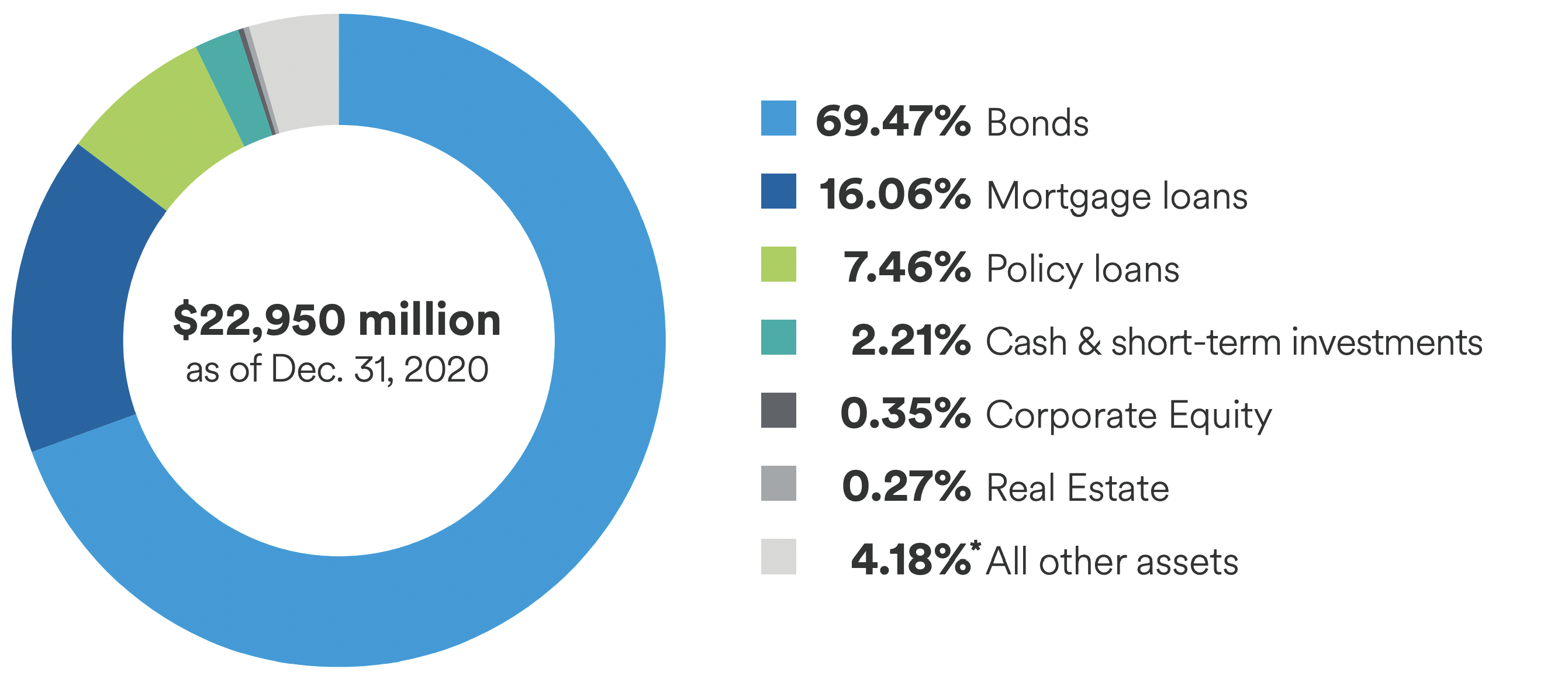

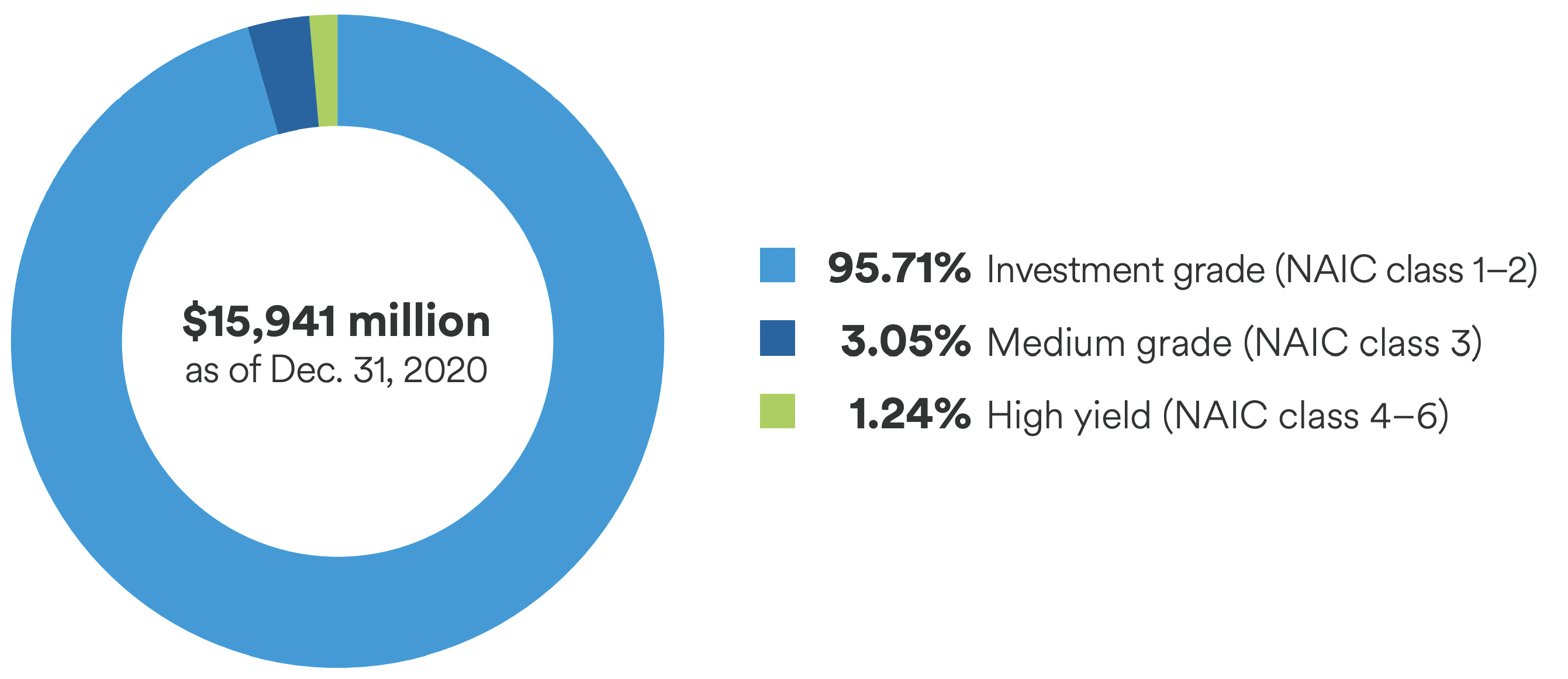

The insurance company’s guarantee is only as good as their financial quality and strength.1 Ask for information about how the company is investing their assets to ensure that they can meet the long-term guarantees that structured settlements provide.1 Find out how much of their general account portfolio is invested in bonds and the respective bond quality.

5. What kind of support will you receive from the insurance company after

the structured settlement has been issued?

Be sure to ask about the insurance company’s digital tools to see if you can access your account online. Also, ask about their customer support after the structured settlement has been issued so that you know who to contact in case you have questions. Structuring your settlement is an important decision that can affect your financial future. Ask the questions above and evaluate the information that you receive to determine the best option for you. Your attorney might be able to help you find a structured settlements specialist or you can find more information from the National Structured Settlements Trade Association at www.nssta.com.

MetLife

Evaluating and choosing a structured settlement provider is not an easy choice. You want to choose an experienced company who you can count on to make your payments. As a structured settlements provider, we are a financially strong company with diverse lines of business and we provide best-in-class service to our customers before and after the annuity purchase. Here’s why we are a top choice:

1. How long has our company been active in the structured settlement market?

We have over 35 consistent years of experience in the structured settlement industry. While other life companies have entered and exited the market, we have remained committed to the success of our industry. Through our industry relationships, $22 billion in structured settlements have been placed with us and we make guaranteed periodic payments to over 92,000 claimants.2

2. What are our company’s credit ratings?

Metropolitan Tower Life Insurance Company’s financial strength and claims-paying ability is currently rated “Superior,” “High Quality” or “Very Strong” by the major rating agencies.3

3. What is the size and strength of our company?

Met Tower Life can assume responsibility for annuity contracts of all sizes. On a statutory accounting basis, Met Tower Life has approximately $35.3 billion in total admitted assets (including separate accounts and approximately $4.1 billion pledged as collateral for any loan or guaranty or which were otherwise not available to pay losses and claims or were not held to protect its policyholders or creditors) and approximately $33.9 billion in liabilities.4

Met Tower Life’s size (as of December 31, 2020)

4. What is our general account investment portfolio composed of?

General Account Investment Portfolio

Bond Quality

5. What kind of support will you receive from us after the structured settlement has been issued?

We provide superior service before and after the structured settlement is issued. You can

access your account online through MyBenefits, our annuitant portal which allows you to check payment status and benefits amounts, update your address and more. If you have questions about your annuity, you can contact our award-winning Customer Solutions Center, which has been recognized by J.D. Power for “An Outstanding Customer Service Experience.”5

With a team of knowledgeable experts, we have been a long-standing provider of structured settlement solutions for many years. Not only can you be confident in our expertise and support, but you can also rest assured that we will continue to make your payments for years to come.

Structured Settlements

Our experts will work with you to build innovative, tax-advantaged solutions that meet you or your client’s unique needs.